Source: sina.com.cn Author: Ping Xiang Date: January 8, 2025

Amid the clamor for “decoupling”, Western investors have neither halted nor withdrawn from the Chinese market. Many foreign investors still hold a favorable view of China.

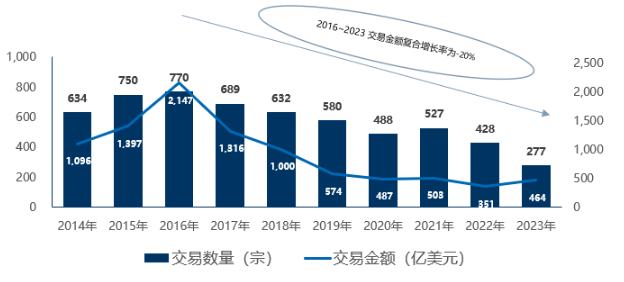

According to data observed by Rhodium Group, over the past three years, the COVID-19 pandemic has cooled the cross-border M&A market. However, 2021 stood out as a year when, despite the severe drag on global economic development caused by the pandemic, the cross-border M&A market remained robust, completing a total of 527 deals and reaching the highest peak in the past three years.

A mid-2023 report by PR Newswire on the impact of changing COVID-19 control policies stated that in 2021, 94% of US-invested companies held an optimistic attitude toward the Chinese market, ranking China as the best investment destination.

Under the “Logjam” Effect: The Operators Behind Cross-border M&A Deals

During the pandemic, three cross-border mergers and acquisitions by U.S. companies in China took place: 1. A global beverage giant acquired a Chinese red date enterprise; 2. A globally leading biopharmaceutical company acquired a well-known domestic leader in the production of single-use medical devices; 3. An acquisition occurred in the semiconductor industry.

For Chinese companies, cross-border M&A represents a path to “going global”. Yet, in doing so, they face unavoidable hurdles such as financial standardization, rationalization of tax and foreign exchange controls, and effective communication between parties. The second deal mentioned above encountered even more complexities. Due to pandemic-related staffing challenges, heightened market uncertainties, and moderate transaction risks, these factors significantly influenced the M&A process.

Who were the key operators behind these cross-border M&A deals?

Among them was Ms. Qiming Lu, a Partner in China at the International Tax division of PwC New York. With 23 years of experience specializing in tax, cross-border M&A is one of her strong suits. She also possesses extensive practical experience in tax planning, M&A investment, and tax advisory.

Ms. Lu had previously become well-known for her innovative application of cross-border equity swaps in acquiring non-listed overseas enterprises. Many U.S. companies specifically named her to lead their M&A efforts. In the case of the global biopharmaceutical M&A deal, the U.S. company expressly invited her to serve as the deal’s tax strategy officer. She led seven teams responsible for due diligence, deal structuring, Sale and Purchase Agreement (SPA) negotiations, and foreign exchange compliance discussions. Working tirelessly, often through the night, she ensured the successful execution of this cross-border transaction.

This successful foreign acquisition of a Chinese company can be described as a “trailblazer” in the era of pandemic-driven cross-border M&A.

Under pandemic-induced uncertainty, corporate valuations need to be more cautious and comprehensive. Factors such as technology, market position, and production capacity of both companies must be re-examined and considered. The typical logic and standards of a stable market environment no longer apply. Simultaneously, the impact of the pandemic on their businesses must be assessed. Under Ms. Lu’s leadership, the team conducted multiple rounds of evaluations and analyses to provide a systematic and comprehensive set of considerations throughout the M&A process, which helped the U.S. company accurately assess the target enterprise’s value and reduce acquisition risks.

Ms. Lu also played a critical role in helping the Chinese company improve its financials, address tax compliance gaps, and ensure foreign exchange compliance. She facilitated effective communication, ultimately enabling both parties to reach a consensus and ensuring that both companies safely “joined hands” in success.

The Overseas Experience of Chinese Companies in a New Environment

With the changing global economic landscape, adjustments in geopolitical conditions, and the strategic and policy support of international cooperation platforms such as the Third “Belt & Road Initiative” Forum for International Cooperation and the APEC meetings, building an open world economy is on the agenda. Against this backdrop, “going global” has become a requisite course for Chinese enterprises.

Whether it’s foreign companies acquiring Chinese firms or Chinese companies acquiring assets overseas, the first critical decision for Chinese enterprises is often “Location”! Here, “Location” means identifying the right geographical area. In other words, companies must align their strategic needs and industry characteristics with the conditions of the U.S. or other target markets and choose an appropriate entry point.

This places higher demands on Chinese enterprises themselves. Financial conditions, asset valuation, and regulatory compliance become “choke points” and the essential “bridgeheads” that must be overcome before going global. The success or failure hinges critically on having a professional M&A advisory team.

The multiple cross-border M&A deals serviced by Ms. Qiming Lu have provided “shortcuts” for Chinese enterprises to “go global,” offering more benefits and conveniences. With the continued assistance of professionals like her, a new dynamic is emerging in Chinese companies’ global ventures.

Currently, although China faces uncertainties in the global economy, shifting policy environments, and market adjustments, the Chinese M&A market remains vibrant and resilient. We firmly believe that, as China’s economy develops and the market continues to open up, Chinese enterprises and assets will keep actively expanding their global footprint through cross-border M&A, demonstrating their international aspirations and global vision.

(End)